Diagnosis

IVF in transition: 2025 realities and what device manufacturers must do now

FinDBest IVF is a global B2B platform that connects manufacturers of fertility and reproductive health devices with IVF-specialist distributors in over 150 countries. We simplify global expansion, regulatory pathway planning, and distributor onboarding.

Each year, the European Society of Human Reproduction and Embryology (ESHRE) Congress reveals not just clinical updates, but also clear signals about where the IVF market is heading.

In 2025, Circular Communications compiled a focused commercial and product roadmap briefing from the event, kindly shared recently by Dr Georg Griesinger on Linkedin.

What follows is a practical breakdown of their insights—designed for medical device manufacturers and clinical users who need to make fast, evidence-based business and product decisions:

The Six Shifts Reshaping IVF

The IVF landscape in 2025 is not simply evolving—it is undergoing structural change.

Six key forces are reshaping how medical devices are adopted, evaluated, and purchased. Manufacturers who adapt early will find more predictable paths to market.

Those who do not risk falling behind as clinics tighten their criteria.

Cost pressures are now the central constraint

IVF remains financially inaccessible for large segments of the population.

In many countries, patients are still paying out of pocket.

The result is a growing preference for solutions designed around total cost of ownership (TCO).

That means not just upfront purchasing price/cost, but reusability, reliability, throughput, maintenance needs, and training time.

Products that align with capital expenditure (CAPEX) models and flexible subscriptions—especially those matched to clinic cash flow—are more likely to be adopted.

Growth in mature markets has flatlined

In many high-income countries, the number of IVF cycles per capita has plateaued.

For manufacturers, that means growth must now come from share gain or geographic expansion, particularly into fast-growing regions like Southeast Asia, the Middle East and North Africa (MENA), and Latin America.

But entering these markets successfully requires localising value propositions and working with distributors who understand IVF workflows and regulatory constraints.

Legal and ethical oversight is tightening

Questions about embryo selection, long-term storage, and artificial intelligence (AI) in diagnostics are under increased scrutiny.

For manufacturers, this raises the bar on traceability, audit readiness, and labeling compliance.

Products now need to include support for standard operating procedures (SOPs), as well as detailed logging and audit trails.

These are no longer differentiators—they are minimum requirements.

Patient experience has become a key decision factor

Clinics are under pressure to not only deliver outcomes but also reduce the emotional and cognitive burden on patients.

Devices that simplify communication, reduce the number of steps in a procedure, and help patients understand “what’s next” are increasingly favored.

Clear interfaces, intuitive indicators, and minimal user intervention all contribute to better adoption.

Clinic consolidation is shifting how buying decisions are made

Independent clinics are being replaced or absorbed by multi-site groups (Eg. US Fertility or IVIRMA, owned by KKR).

These groups prioritise enterprise-style purchasing: standardised protocols, centralised training, measurable return on investment (ROI), and clear service levels.

Manufacturers that can offer SOP kits, multi-site onboarding, and enterprise-level value metrics will have a distinct advantage.

Technology alone no longer drives differentiation

Automation, AI, microfluidics, smart incubation systems, and digital integration are becoming standard.

The key to winning adoption now lies in reproducibility, data quality, interoperability, and auditability—not just product specifications.

Clinics expect devices that integrate easily with their digital systems and produce consistent results across different settings.

Each of these shifts presents a challenge, but also a roadmap.

Cost, regulation, technology, and buyer behavior are all converging toward a more structured and evidence-driven IVF market.

Manufacturers who address these realities in their design, pricing, and commercial execution will be best positioned to scale.

Clinical and Technological Frontiers Highlighted at ESHRE 2025

Beyond the market dynamics, ESHRE 2025 spotlighted several areas of clinical innovation that are directly shaping device and diagnostics development.

These themes are not theoretical—they are influencing purchasing, adoption, and regulatory expectations now.

Ovarian stimulation protocols are being rethought As clinics aim for personalisation and patient comfort, the need for smarter diagnostics and more flexible drug delivery systems is growing.

Biomarkers that can predict ovarian reserve and treatment response are informing stimulation protocols, making room for devices that adapt to individual profiles.

At the same time, there is a clear trend toward mild stimulation protocols, which create demand for less-invasive monitoring tools and delivery systems that are intuitive, reliable, and easy to train on.

The ongoing refinement of protocols using gonadotropin-releasing hormone (GnRH) antagonists reinforces the need for workflow-agnostic solutions—those that can fit into varying cycles without adding complexity.

Embryo selection is moving well beyond morphology

Objective, evidence-backed methods are replacing subjective scoring.

One major area of interest is AI-supported time-lapse imaging, which offers the potential to assess embryo viability in a more standardised and reproducible way.

However, clinics are demanding validated tools—classified appropriately as software as a medical device (SaMD), with integration capabilities and clean clinical evidence.

In parallel, non-invasive preimplantation genetic testing (niPGT) is gaining momentum.

Media capable of capturing cell-free DNA (cfDNA), paired with ultra-sensitive genetic testing platforms, could redefine embryo selection workflows.

This is not a future trend—it’s a present R&D priority.

Manufacturers need to plan both the evidence and regulatory strategy from the outset.

Metabolomics and biomarker analysis of culture media are also being explored, particularly where kits can offer clear utility and fit easily into existing lab infrastructure.

Implantation remains a key bottleneck

Even with viable embryos, successful transfer remains challenging.

There is growing interest in non-invasive endometrial diagnostics that can assess uterine receptivity without disrupting workflow.

The market demands tools that are specific, reproducible, and easy to use.

Meanwhile, catheter design continues to influence both outcomes and patient experience.

Ergonomics, atraumatic placement, and consistent delivery are still core drivers of successful transfers.

While less discussed in marketing, this area remains a top priority for clinical users and therefore deserves more innovation attention.

Taken together, these frontiers point toward a product development path that favors integration over novelty, reproducibility over experimentation, and real-world usability over theoretical performance.

It is not just what your device does—it is how it fits into the day-to-day life of clinics under pressure.

Regulatory and Market Access: Build It In, Not On

Global regulatory expectations are rising, and shortcuts are closing.

Product teams can no longer afford to treat compliance as a post-development task. It must be embedded from Day 0.

For software and AI-based tools, classification is tightening across the United States, European Union, and China.

This means developers must create full validation plans early, align endpoints with regulatory expectations, and document cybersecurity and data governance practices before launch.

Post-market surveillance and post-market clinical follow-up are not optional; they need to be built into the development process.

Culture media and reagent products are under increased scrutiny from regulations like the European Union’s Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR).

Manufacturers must establish robust quality systems, ensure all labeling is complete and language-appropriate, and be ready to implement unique device identification requirements in every target market.

For connected lab devices, regulatory bodies expect more than just functionality.

They now require detailed documentation of data interoperability, security protocols, and integration capabilities.

Manufacturers should design clean application programming interfaces (APIs) and seamless connectors for hospital and laboratory data systems to make compliance easier—not harder—for clinics.

A practical checklist for manufacturers:

- Confirm software classification and plan validation early for each market.

- Create templates for traceability, labeling, audit logs, and PMS/PMCF.

- Implement cybersecurity and data protection frameworks from Day 0.

- Ensure unique device identification (UDI) compliance for each geography.

- Offer clear integration documents for lab systems (no assumptions).

Strategic Focus Areas for IVF Device and Diagnostics Manufacturers

- Balance cost and innovation

Demonstrate lower total cost of ownership through real-world data. Show how your product reduces maintenance, training time, or consumable use. - Support with evidence, not claims

Build prospective, multi-site clinical studies. Prepare audit-ready documentation: instructions for use, labeling, traceability, and surveillance templates. - Integrate digital and physical

Provide open, secure APIs. Ensure fast and simple onboarding for embryologists and nurses. Focus on reducing clicks, errors, and delays. - Refine embryo selection strategy

Align product claims with validated inputs—whether AI models, cfDNA media, or metabolomic markers. Monitor data drift and revalidate regularly. - Improve uterine receptivity and transfer tools

Support claims with performance data (e.g. time to placement, consistency). Offer quick training modules to accelerate adoption. - Embed regulatory design

Maintain a live matrix of requirements per SKU and market. Don’t delay planning for UDI, cybersecurity, PMS/PMCF. - Sell to enterprise buyers

Offer group-level SOP kits, ROI calculators, and centralised onboarding. Provide remote diagnostics and clear SLAs to reduce downtime. - Speed up market entry through smarter distribution

Use IVF-experienced distributors with proven regulatory capabilities. Shorten time to first order by removing the guesswork.

Key Takeaways

- Total cost of ownership is now the key metric—design around it.

- Patient workflows and clinic processes must be simplified.

- Reproducibility and integration matter more than specs.

- Plan evidence generation around the claims you want to make.

- Prepare for audits with full traceability and post-market tools.

- Offer group-ready commercial packages for multi-site chains.

- Match each market with a localised regulatory strategy.

- Choose distributors who understand both IVF and compliance.

FinDBest IVF: Your Partner in Global Expansion

These insights from ESHRE 2025, as compiled by Circular Communications, offer a compelling glimpse into the future of fertility treatment.

For medical device manufacturers, these trends are direct signals for where to focus R&D, innovation, and market entry efforts.

At FinDBest IVF, we specialise in helping medical device manufacturers navigate the complex global regulatory landscape.

Whether you’re developing cutting-edge AI for embryo selection, next-generation culture media, or advanced cryopreservation devices, we can help you:

- Find regulatory-savvy distributors and license holders.

- Identify partners who understand country-specific timelines and dossier formats.

- Expand globally, faster — with fewer surprises.

Credits

- Original, full report by Circular Communications

- Shared on Linkedin by Georg Griesinger

Insight

Women better protected against early Parkinson’s neurodegeneration, study finds

Women with an early precursor to Parkinson’s disease show much less brain shrinkage than men, despite similar disease severity, new research shows.

The discovery could help scientists explore how hormones might one day be used to treat the neurodegenerative condition.

The findings are based on data from nearly 700 participants across nine international research centres.

The study focused on isolated REM sleep behaviour disorder — a condition in which people physically act out their dreams.

It is considered the most reliable early warning sign of diseases caused by toxic protein build-up in the brain.

More than 70 per cent of those affected later develop Parkinson’s disease, Lewy body dementia or multiple system atrophy, which affects several body systems.

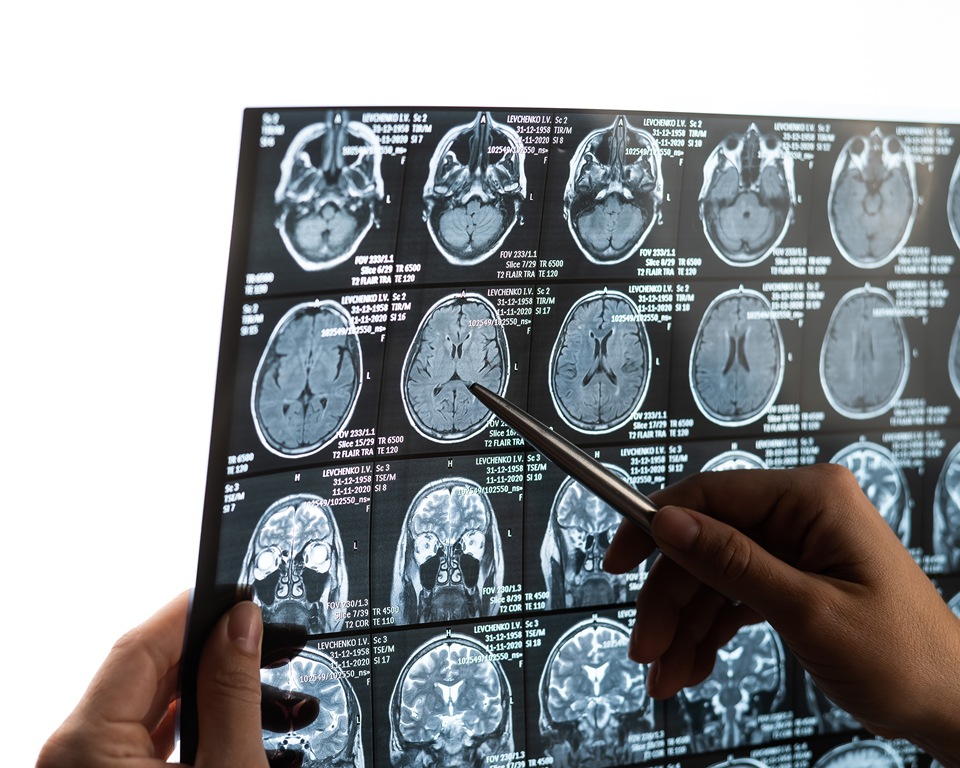

Researchers from Université de Montréal analysed 888 brain scans from centres in Canada, the Czech Republic, the UK, France, Australia, Denmark and Italy.

After quality checks, 687 participants were included: 343 patients with the sleep disorder and 344 healthy controls.

The results revealed clear sex-based differences.

While 37 per cent of the cortical areas — the brain’s outer layer responsible for higher functions — showed thinning in men, only one per cent of regions were affected in women.

This difference remained even though participants were of similar age (around 67) and had comparable clinical profiles.

Marie Filiatrault is first author of the study and a doctoral student at Université de Montréal.

The researcher said: “Men show much more extensive and severe cortical thinning — the outer layer of the brain that controls our higher functions — than women, particularly in areas linked to movement, sensation, vision and spatial orientation.”

To understand the protective effect, researchers compared brain images with gene activity in different regions, measured in healthy brains after death.

They found that the less-affected areas in women showed higher expression of genes related to oestrogen function, particularly ESRRG and ESRRA, which produce oestrogen-related hormone receptors.

The ESRRG gene was especially notable, showing greater activity in brain tissue than elsewhere in the body.

These receptors play key roles in mitochondrial function — the cell’s energy production system — and in the survival of dopamine-producing neurons, the cells that die in Parkinson’s disease.

Shady Rahayel is professor at Université de Montréal’s Faculty of Medicine and lead author of the study.

Rahayel said: “This sleep disorder offers a unique window of opportunity to study the mechanisms of neurodegeneration before major motor or cognitive symptoms appear.

“Our results suggest that certain brain areas in women with isolated REM sleep behaviour disorder are better protected than those in men, likely through the action of oestrogens.”

The team chose to study this precursor condition because it allows observation of brain protection mechanisms before major motor symptoms develop.

Although only 25 to 40 per cent of people with Parkinson’s experience REM sleep behaviour disorder, studying this early stage gives insight into how the brain resists damage when it is still limited.

Previous studies have shown that women with established Parkinson’s disease tend to experience slower progression than men, pointing to similar protective effects.

The findings could shape future research and treatment development.

The authors recommend separating men and women in clinical trials, which could improve statistical accuracy and reduce the number of participants required.

The biological mechanisms identified — particularly those linked to the ESRRG gene — could also become potential therapeutic targets.

Early laboratory research suggests that increasing ESRRG activity may protect dopamine-producing neurons from the toxic effects of alpha-synuclein, a protein that builds up abnormally in the brains of people with Parkinson’s.

“This study brings us closer to precision medicine, where treatments could be tailored not only to the disease but also to individual biological characteristics, including sex,” said Rahayel.

News

Dozens of women report suffering painful burns after using Always sanitary towels

Dozens of women have claimed online that Always sanitary towels caused painful burns, prompting a response from the Procter & Gamble-owned brand.

Several TikTok users have posted videos describing reactions to the company’s products in recent days.

The clips, which have gained thousands of views, include complaints of itching, rashes and what users describe as chemical burns — skin damage caused by contact with irritating substances.

In one video viewed 45,000 times, user @ratqueen910 said the pads gave her “the worst chemical burns ever” in her groin area, where underwear meets the leg.

“When I looked at the burn with the flash on it really looked like my skin was gooey! I was scared af,” she told commenters.

She said she first thought the pain was chafing or an allergic reaction to spandex in her underwear, before seeing other women online describe the same symptoms.

“I realised that so many people have had problems the last few months with these pads,” she said.

“It’s not like, ‘oh, I switched over to Always pads’ — no, I’ve used them since I was in like sixth grade.

“So they must have changed the formula, messed something up, put some extra chemicals in that sh**t because it messed me up. I had chemical burns. I had issues and I didn’t know what it was.”

She said a doctor suggested another cause for the irritation, but she believes the pads were to blame, noting she had never been sensitive to scents or suffered urinary or yeast infections before.

Her post drew hundreds of comments, with many women saying they too had reactions to Always’ Flexfoam pads.

One wrote: “The whole area that the pad touched gave me a chemical burn after only a few hours. It was the Flexfoam.”

The original poster replied: “Mine was Flexfoam as well.”

While users did not specify exact product types, Always sells both day and night versions of its Infinity Pads with Flexfoam, which appear to be those mentioned.

Another commenter said: “Just a few days ago I was on my period using Always pads and I was f**king itching and it was burning. I never itch or have pain down there. I took the pad off so quick.”

A third wrote: “I switched to Honey Pot and had been fine. When my coworker gave me an Always pad, I was hesitant but used it — and got a chemical burn.”

Others described repeated irritation.

One said: “I use another brand for the first half of my period, then Always for the last two days, and I’ve had this burn for three months in a row. Stopped using them last month and no issue.”

Some also reported rashes or itching. One wrote: “In real time I am itching and getting a rash. I wore an Always pad earlier today.”

An Always spokesperson told the Daily Mail: “Our pads are used safely by millions of women every day around the world.

“Their safety is our top priority, and we carefully evaluate every component of our Always products to minimise the chances of skin irritation or allergic reactions.”

News

Earlier menopause may harm heart-brain health connection, study suggests

Women who experience menopause earlier in life may face damage to the connection between heart function and brain health, new research suggests.

The study of more than 500 participants examined whether an earlier age at menopause affects the relationship between cardiac performance and cognitive function, as well as changes in brain structure.

Researchers from the University of Toronto and Sunnybrook Research Institute assessed how reduced heart function and early menopause together influence brain health in women, who are already at greater risk of both cardiovascular disease and Alzheimer’s disease.

Heart performance was measured using resting left ventricular ejection fraction — the proportion of blood pumped out with each heartbeat — captured through cardiac MRI scans.

Brain MRI scans assessed grey matter volume (the nerve-cell-rich tissue) and white matter hyperintensity burden, which indicates areas of damage linked to ageing and vascular disease.

Participants also completed standardised cognitive tests, with results adjusted for factors including age, ethnicity, education, hormone therapy use and whether menopause occurred naturally or through surgery.

The findings suggest that early menopause and reduced heart function may have a combined negative impact on the brain.

Weaker cardiac output can limit oxygen and nutrient flow to brain tissue, increasing the risk of damage and dementia over time.

Tallinn Splinter is lead author from the University of Toronto and Sunnybrook Research Institute.

The researcher said: “We still don’t fully understand how menopause, and particularly earlier menopause, affects brain ageing.

“By examining the link between heart and brain health, we wanted to shed light on this important but often overlooked area.”

Previous studies have shown that earlier menopause is linked with higher risks of cognitive decline and Alzheimer’s disease.

This research builds on that evidence by showing how menopause timing and heart health interact to influence brain outcomes.

Dr Stephanie Faubion, medical director for The Menopause Society, said: “These findings highlight the importance of including sex-specific factors, such as age at menopause, in dementia research and in developing prevention and intervention strategies.”

Menopause2 weeks ago

Menopause2 weeks agoFDA plans to revise black box warning on menopause hormone therapies

Wellness2 weeks ago

Wellness2 weeks agoAI-powered women’s health companion Nexus launches in UK

Fertility2 weeks ago

Fertility2 weeks agoScientists turn human skin cells into eggs in IVF breakthrough

Wellness6 days ago

Wellness6 days agoWomen’s health innovations recognised in TIME’s Best Inventions 2025

News2 weeks ago

News2 weeks agoDaily pill could delay menopause ‘by years,’ study finds

News2 weeks ago

News2 weeks agoAncient herb to modern must-have: Why ashwagandha is capturing UK women’s attention

Menopause3 weeks ago

Menopause3 weeks agoNew report exposes perimenopause as biggest blind spot in women’s health

News1 week ago

News1 week agoMenstrual cycle affects women’s reaction time, study finds